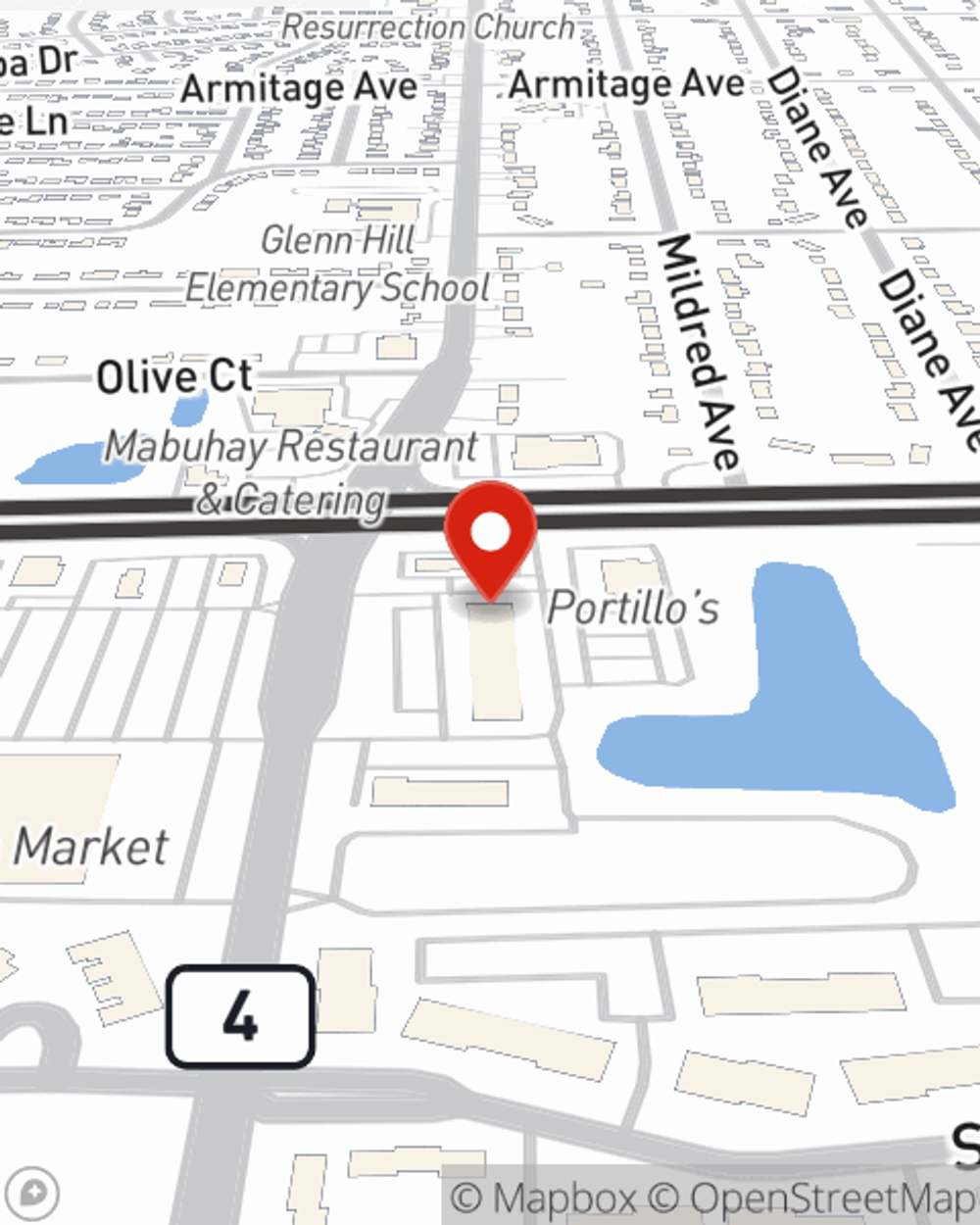

Business Insurance in and around Glendale Heights

Looking for small business insurance coverage?

No funny business here

- Glendale Heights

- Carol Stream

- Bloomindale

- Wheaton

- Lombard

- Addison

- Villa Park

- Roselle

- Winfield

- West Chicago

- Hanover Park

- Aurora

- Warrnville

- Franklin Park

- Melrose Park

- Elgin

- Chicago

- Illinois

- Schaumburg

- Bartlett

- St. Charles

- Batavia

- Cicero

- Lisle

Your Search For Fantastic Small Business Insurance Ends Now.

Do you own a camping store, a stained glass shop or a window treatment store? You're in the right place! Finding the right coverage for you shouldn't be risky business so you can focus on making this adventure a success.

Looking for small business insurance coverage?

No funny business here

Customizable Coverage For Your Business

Your business thrives off your determination passion, and having fantastic coverage with State Farm. While you make decisions for the future of your business and do what you love, let State Farm do their part in supporting you with commercial auto policies, worker’s compensation and commercial liability umbrella policies.

Since 1935, State Farm has helped small businesses manage risk. Visit agent Eddie Vargas's team to discuss the options specifically available to you!

Simple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

Eddie Vargas

State Farm® Insurance AgentSimple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.