Homeowners Insurance in and around Glendale Heights

Looking for homeowners insurance in Glendale Heights?

The key to great homeowners insurance.

Would you like to create a personalized homeowners quote?

- Glendale Heights

- Carol Stream

- Bloomindale

- Wheaton

- Lombard

- Addison

- Villa Park

- Roselle

- Winfield

- West Chicago

- Hanover Park

- Aurora

- Warrnville

- Franklin Park

- Melrose Park

- Elgin

- Chicago

- Illinois

- Schaumburg

- Bartlett

- St. Charles

- Batavia

- Cicero

- Lisle

Home Is Where Your Heart Is

Being at home is great, but being at home with protection from State Farm is the cherry on top. This great coverage is more than just precautionary in case of damage from hailstorm or tornado. It also has the ability to protect you in certain legal situations, such as someone slipping in your home and holding you responsible. If you have the right coverage, these costs may be covered.

Looking for homeowners insurance in Glendale Heights?

The key to great homeowners insurance.

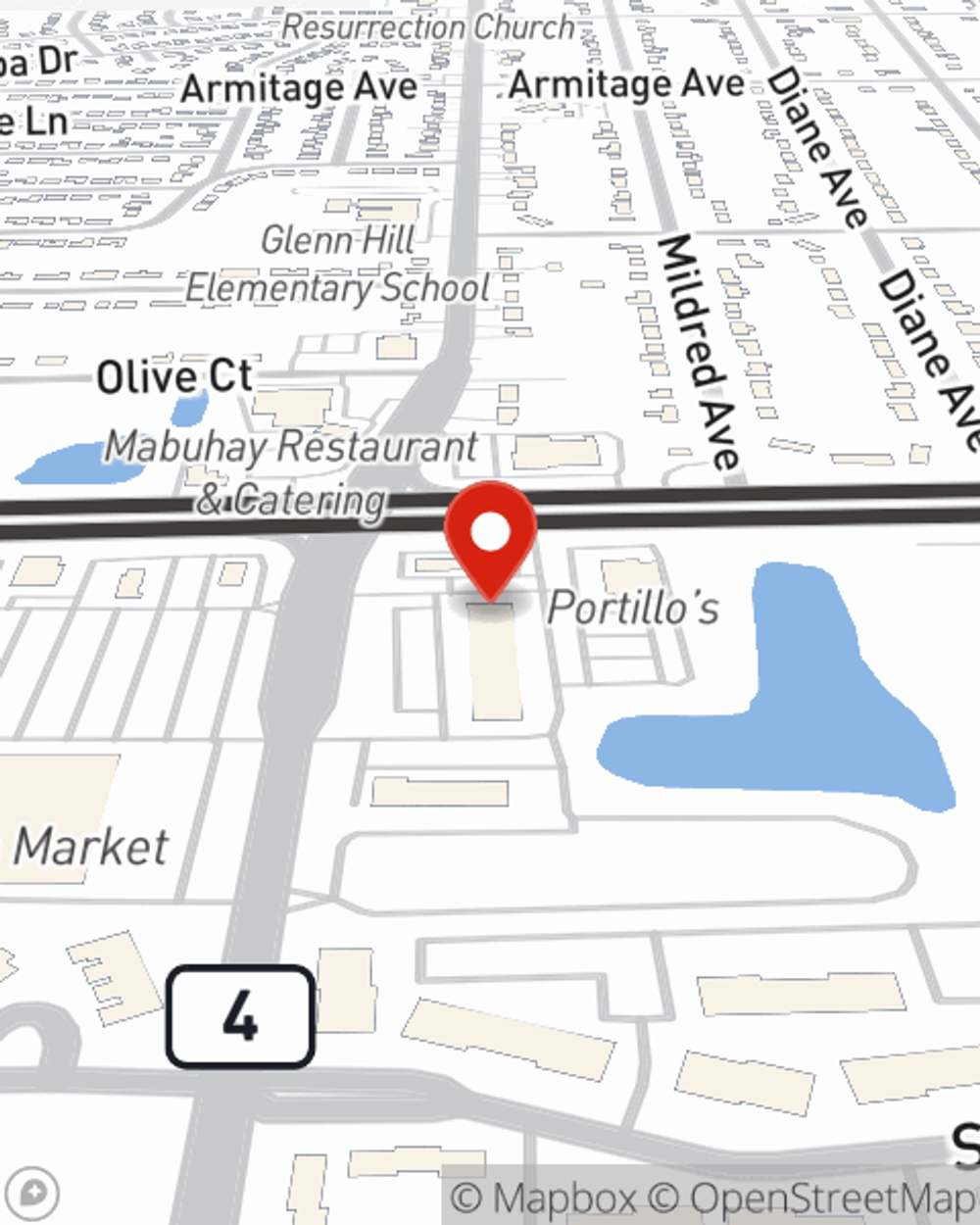

Agent Eddie Vargas, At Your Service

State Farm's homeowners insurance is the right move. Just ask your neighbors. And reach out to agent Eddie Vargas for additional assistance with choosing the right level of coverage.

So visit agent Eddie Vargas's team for more information on State Farm's remarkable options for protecting your home and possessions.

Have More Questions About Homeowners Insurance?

Call Eddie at (630) 462-0797 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Surprising household hazards

Surprising household hazards

Some household safety risks may surprise you and knowing a few of the culprits is important to help prevent accidents in your home.

Flood insurance: What to know

Flood insurance: What to know

Learn the essentials of flood insurance and why it’s important for protecting against one of the costliest natural disasters in the United States.

Eddie Vargas

State Farm® Insurance AgentSimple Insights®

Surprising household hazards

Surprising household hazards

Some household safety risks may surprise you and knowing a few of the culprits is important to help prevent accidents in your home.

Flood insurance: What to know

Flood insurance: What to know

Learn the essentials of flood insurance and why it’s important for protecting against one of the costliest natural disasters in the United States.